How to get Personal Loan in UAE on 2500 Salary

Every bank in UAE offers a variety of personal loans for UAE nationals and UAE residents (expatriates). You should check the options available in personal loans to find out a suitable for you.

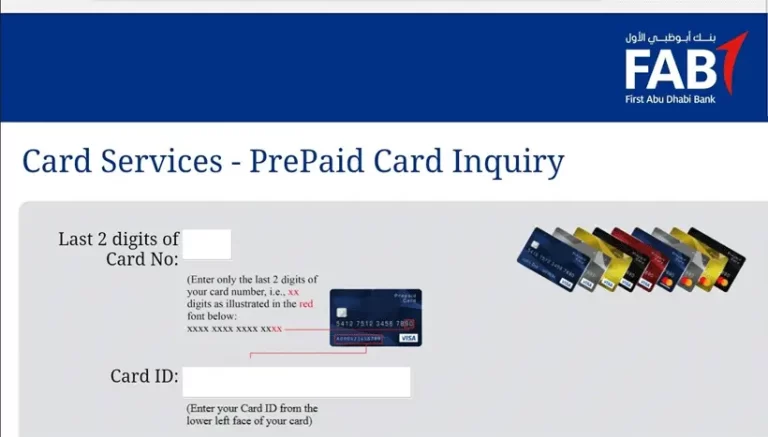

The minimum salary for a personal loan is AED 3000 in UAE. In case your salary is AED 2500 or below 3000, you are not eligible for a personal loan. In such circumstances, you can get FAB revolving overdraft facility in your salary account.

With the salary of AED 2500 per month, the First Abu Dhabi Bank provides AED 2500 revolving overdraft per month. It is not a personal loan but it is very useful for people with AED 2500 or low salary in United Arab Emirates.

Table of Contents

Can I Get Personal Loan in UAE on AED 2500 Salary?

No, you cannot get a personal loan in UAE on AED 2500 salary. Because the banks in UAE offer personal loans to individuals with minimum monthly salary of AED 3000 or more.

In addition, the banks have some specific eligibility criteria for lending personal loans.

But you can use FAB Revolving Overdraft Facility for urgent need of money. Here i will explain all about FAB Revolving Overdraft Facility.

What is FAB Revolving Overdraft Facility?

FAB Revolving Overdraft Facility is a revolving credit facility provided by First Abu Dhabi Bank to its customers. It is not a personal loan but it allows you to borrow up to twice of your salary per month and repay it later. The bank will charge 3.65% interest per annum and calculate it at the end of the month.

The revolving overdraft facility is very useful for people who need money urgently but cannot get a personal loan on 2500 salary in UAE. The FAB bank provides overdraft facility linked to customer’s operative account. The interest is charged only if the customer utilizes the overdraft facility.

Due to revolving overdraft facility, your bank account balance can fluctuate positive to negative and negative to positive. It depends upon your usage and salary credit cycle.

For example: You have a bank account at First Abu Dhabi Bank and revolving overdraft facility is active in your account. Your salary is AED 2500 and your overdraft limit is AED 2500 per month.

The overdraft facility is active in your account but the FAB bank will charge interest on overdraft only when you utilize the overdraft.

Eligibility Criteria for FAB Revolving Overdraft Facility

You can get FAB revolving overdraft facility in your salary account if you meet the eligibility criteria mentioned below.

- Your age is 21 years or above.

- You have a valid Emirates ID, passport and UAE residence visa.

- You have a salary account with FAB.

- You earn a minimum salary of AED 2000 per month.

- With AED 2000 to 5999 Salary, Get up to 1 time of your salary amount as overdraft every month.

- With AED 6000 & above Salary, Get up to 2 time of your salary as overdraft with maximum AED 50,000 per month.

So, you can get FAB revolving overdraft facility on AED 2500 salary to face unexpected circumstances and expenses in life.

Final Opinion

The personal loans are available for all salaried and self-employed individuals in UAE. Depending upon your need, you can apply for a personal loan in UAE but you must check your eligibility for the loan before you submit your application.

Getting a personal loan with a low salary of 2500 or less is difficult in UAE. Many people with a low salary need a loan for some urgent expenses. Therefore they are looking for a bank that can give them a personal loan on AED 2500 salary without any collateral.

FAQs

When you are need of money, you can think about getting a personal loan. But it is important to know the eligibility for a personal loan in UAE on low salary before you apply for it. Here I provide some questions about personal loan in UAE and their answers in brief.

Can I get a personal loan with 2500 AED salary?

No, you cannot get a personal loan with 2500 AED salary because the minimum salary required for a personal loan in UAE is 3000 AED.

How much personal loan can I get on my salary in UAE?

You can get a personal loan up to 20 times of your salary value in UAE. The bank will decide your personal loan amount based on your salary, credit history, credit score and other eligibility criteria.

What is minimum salary for a personal loan in UAE?

The minimum salary for a personal loan in UAE is AED 3000. Some banks have set AED 5000 as minimum salary for a personal loan in United Arab Emirates.

![Filipino Money Lender in Dubai [Where Can you Find] 9 Filipino Money Lender in Dubai](https://uaexpatriates.com/wp-content/uploads/2023/12/Filipino-Money-Lender-in-Dubai-768x432.webp)